Plan Your Financial Future with Expert Guidance

In today's complex financial landscape, our expert agents are here to help you navigate the uncertainties and design a customized plan that aligns with your unique financial goals and aspirations.

Ethical and Financial Responsibility

What we do

As licensed and certified agents, we hold ourselves to the highest ethical standards. Your financial interests always come first, and we are dedicated to providing you with unbiased advice that is solely in your best interest. You can trust us to act with integrity and professionalism.

Good Approach

Great Ideas

Save Money

Detailed Report

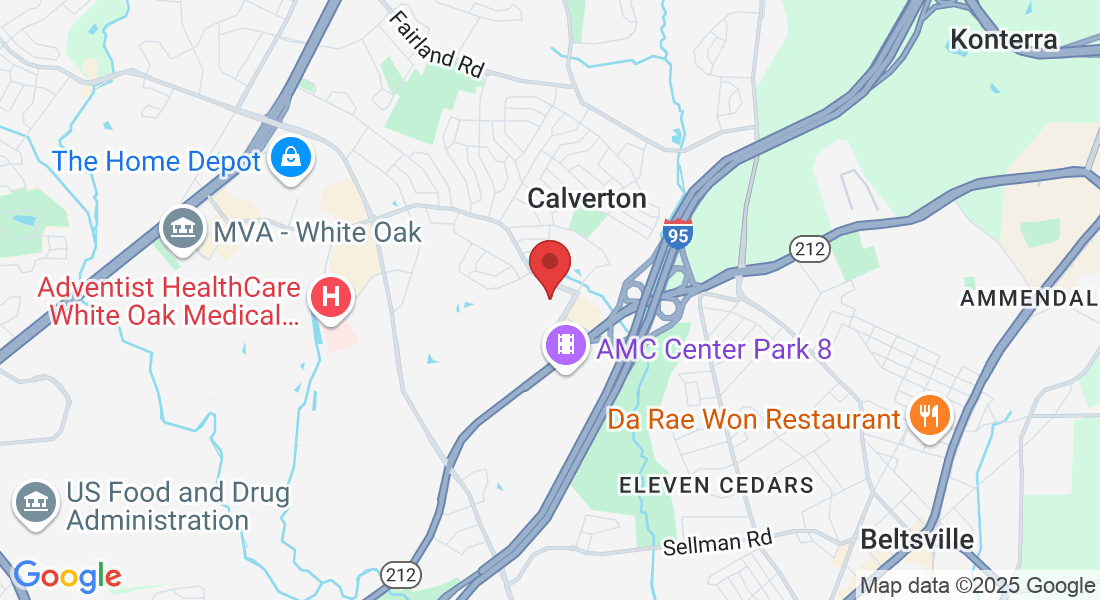

Around-the-Clock Financial Protection

At Hard Roc Academy, we understand that your retirement savings and income are of utmost importance to you and your family. We offer one of the few products in the country that can guarantee 100% income protection. Even in a down market!

Comprehensive Financial & Retirement Planning

We offer comprehensive financial and retirement planning and life insurance services, which involve a holistic assessment of a client's financial situation. We work closely with clients to set financial goals, create personalized financial plans, and provide ongoing guidance to help them achieve their objectives. We cover retirement planning, wealth protection, tax savings, free-living benefits, and long-term care.

Final Expense - Burial Expense

We offer final expense insurance called "Living Promise Whole Life Insurance" plan, designed specifically to cover funeral and burial costs without burdening your family financially. We partner with highly rated providers to help you get affordable coverage to prepare for when that time comes to take care of our loved ones.

Retirement Planning- Income For Life

Fixed Indexed Annuities (FIAs) offer guaranteed principal protection with growth potential tied to market index performance, ensuring your initial investment is safe from market losses while still allowing for upside participation. These tax-deferred vehicles provide flexible payout options, including guaranteed lifetime income streams, making them ideal for retirement planning without annual contribution limits. FIAs include valuable features like premium bonuses, optional riders for enhanced benefits, and probate avoidance for beneficiaries. With built-in floor protection during market downturns and the ability to handle large rollover amounts from 401(k)s or IRAs, FIAs deliver both security and growth potential for conservative investors seeking predictable retirement income.

Wealth Protection and Wealth Transfer

Indexed Universal Life (IUL)

IULs offer a powerful combination of growth, protection, and flexibility. They provide a tax-free death benefit, tax-deferred cash value growth linked to market indexes, and downside protection from market losses. Policyholders can also access tax-free loans for retirement income, emergencies, or wealth transfer, with no contribution limits and optional living benefits for added peace of mind. Tax-Advantage Death Benefit & Cash Value Growth. Estate Planning, Living Benefits & No Caps on Contributions.

FAQS

What is the benefit of working with a Licensed Agent?

Working with a financial advisor offers numerous benefits. First and foremost, advisors provide expertise and guidance tailored to your unique financial situation and goals. They can help you create a comprehensive financial plan, optimize your investments, minimize taxes, and ensure you're on track to achieve your financial objectives. Additionally, advisors offer peace of mind, knowing that you have a professional managing your financial affairs and helping you make informed decisions.

How do I choose the right financial advisor for my needs?

Choosing the right financial advisor is a critical decision. Start by assessing your own financial goals and preferences. Look for advisors with the appropriate qualifications and certifications, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Consider their experience, specialization, and track record. It's also important to have a consultation or interview to ensure their approach aligns with your values and objectives. Lastly, check for transparency in fees and compensation to avoid surprises.

Do I need a large portfolio to benefit from financial advisor services?

No, you don't need a large portfolio to benefit from financial advisor services. Financial advisors can assist individuals at various stages of their financial journey, from those just starting to save to those with substantial assets. Advisors can help you create a financial plan, manage debt, set up an emergency fund, and make the most of your resources, regardless of your current wealth. Their goal is to help you improve your financial well-being and work towards your financial goals, whatever they may be.

What Are Our Customers Saying ?

Feedback from our satisfied clientele.

I can't thank Eric, my licensed agent, enough for their unwavering support and expert guidance when my husband and I faced a sudden life crisis that devastated our family. Fortunately, we have permanent protection, and although we can never recover a life, I was able to pay off my house, my children's college tuition, and now I am debt-free. Thank you, Hard Roc Academy!

LISA SMITH

First of all I rarely leave reviews! I've been a client of Hard Roc Academy for years, and I can confidently say they've transformed my financial outlook. Their Indexed Universal Life has allowed me to seize income growth opportunities at the right moment and navigate market turbulence with ease. It only took a 15-minute free consultation to learn more about their products and services. One of the best decisions of my life!

MICHAEL LEWIS